Fidelity Investments Instructions for Completing IRS Section 83(b) Form free printable template

Show details

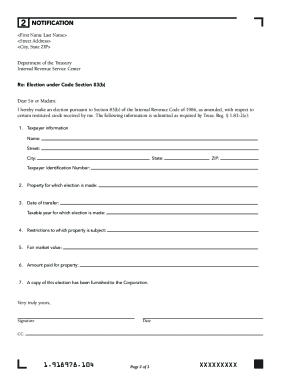

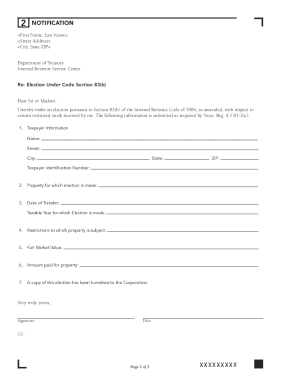

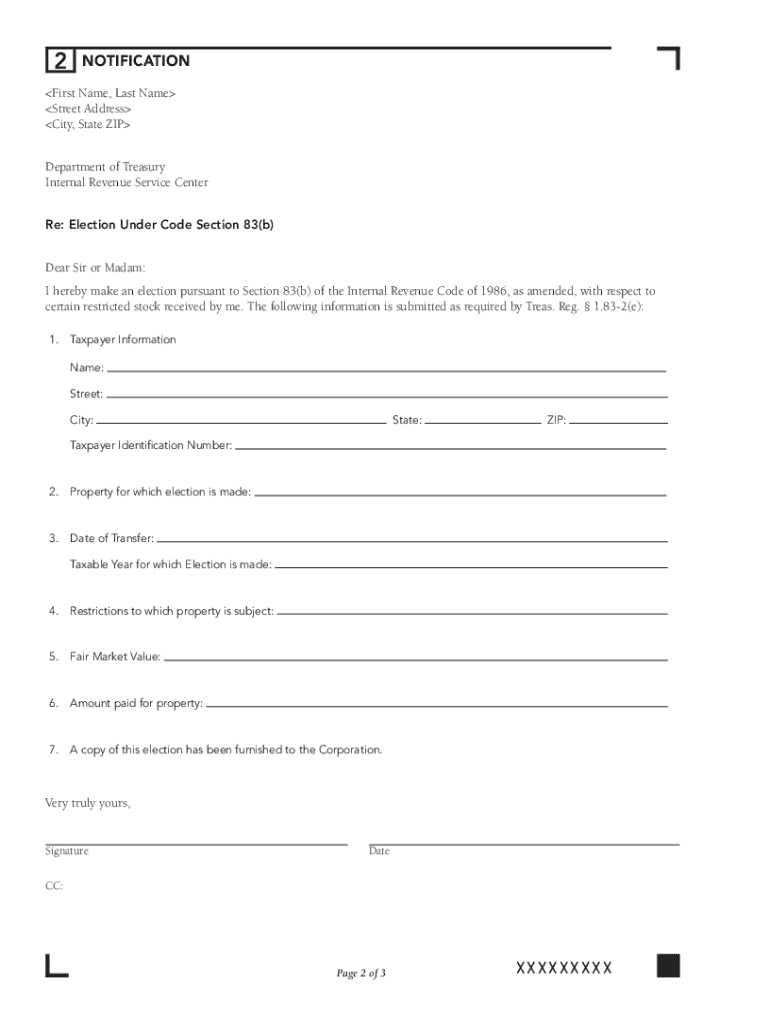

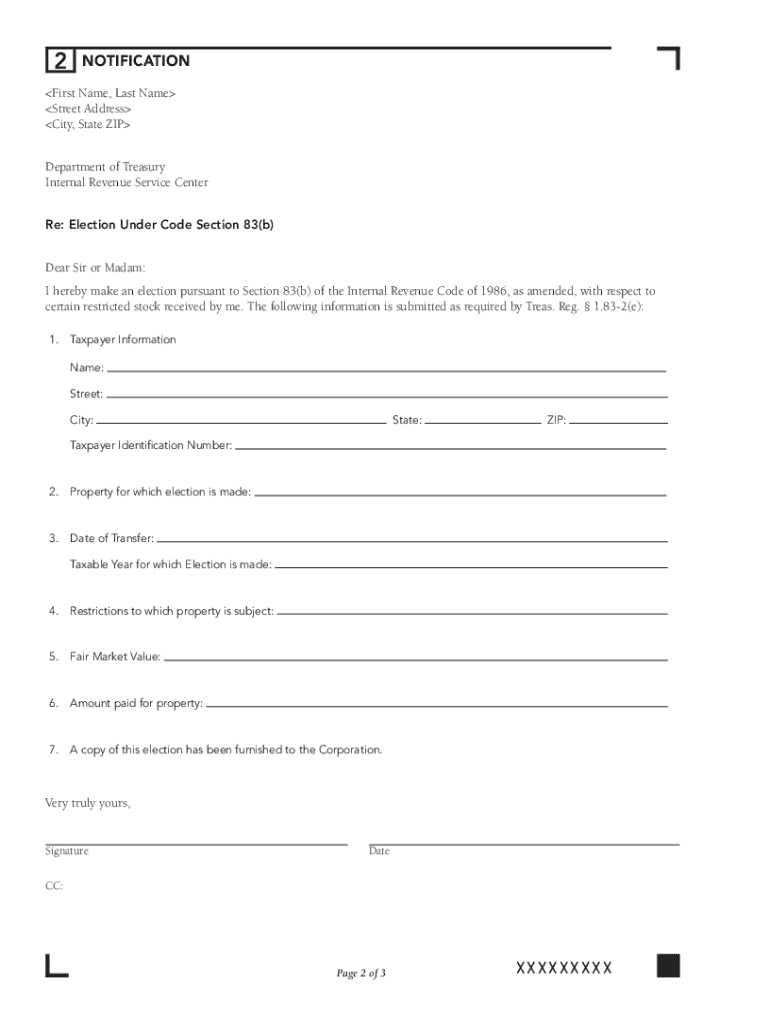

Instructions for Completing IRS Section 83(b) Form 1 INSTRUCTIONS To make an 83(b) election you must complete the following steps within 30 days of your Award Date: Complete the IRS 83(b) form that

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Fidelity Investments Instructions for Completing IRS Section

Edit your Fidelity Investments Instructions for Completing IRS Section form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fidelity Investments Instructions for Completing IRS Section form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Fidelity Investments Instructions for Completing IRS Section online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Fidelity Investments Instructions for Completing IRS Section. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity Investments Instructions for Completing IRS Section 83(b) Form Form Versions

Version

Form Popularity

Fillable & printabley

4.5 Satisfied (37 Votes)

4.8 Satisfied (185 Votes)

4.7 Satisfied (55 Votes)

How to fill out Fidelity Investments Instructions for Completing IRS Section

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)

01

Obtain the IRS Section 83(b) Election form from the IRS website or Fidelity Investments.

02

Fill out your name, address, and taxpayer identification number at the top of the form.

03

Describe the property you are transferring by detailing what you received (e.g., shares of stock).

04

State the date of the property transfer and the date the election is being made.

05

Include the fair market value of the property at the time of transfer and the amount, if any, paid for the property.

06

Sign and date the form to certify the accuracy of the information provided.

07

Send the completed form to the IRS within 30 days of the property transfer.

08

Provide a copy of the completed election to your employer and retain a copy for your records.

Who needs Fidelity Investments Instructions for Completing IRS Section 83(b)?

01

Individuals who have received property in connection with the performance of services, such as employees receiving stock options or restricted stock.

02

Taxpayers who wish to elect to include the fair market value of the property in their taxable income at the time of transfer rather than at the time the restrictions lapse.

Fill

form

: Try Risk Free

People Also Ask about

How do I file an electronic 83b?

What are the steps to filing an 83(b) election? Complete a Section 83(b) election letter. Mail the completed letter to the IRS within 30 days of your grant date: Mail a copy of the completed letter to your employer. Retain one copy of the completed and filed letter for your records and retain proof of mailing.

Can 83 B elections be signed electronically?

Update: The IRS has extended temporary electronic signing and filing for 83(b) elections through Oct. 31, 2023, streamlining this complicated tax process for founders and employees.

What happens if you don't file 83 B within 30 days?

After a normal stock grant has been made to a founder, and that founder has missed her 83(b) deadline, the company and the founder can simply amend the stock grant to change the repurchase price from par value to fair market value.

How to file 83b election electronically?

Sign your 83(b) election form electronically Choose shares that are eligible for early exercise in Carta. Access the digital 83(b) election form. Fill out the form and provide a digital signature. Submit your form for Carta to mail on your behalf. Track the form.

Does IRS accept electronic signatures?

How does the e-signature option work? Taxpayers, who currently use Forms 8878 or 8879 to sign electronic Forms 1040 federal tax returns or filing extensions, can use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

Is there an 83b election form?

To make an 83(b) election, you must complete the following steps within 30 days of your grant date: • Complete the IRS 83(b) form on page 2. Mail the completed form to the IRS within 30 days of your grant date. Address it to the IRS Service Center where you file your taxes.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Fidelity Investments Instructions for Completing IRS Section?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific Fidelity Investments Instructions for Completing IRS Section and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit Fidelity Investments Instructions for Completing IRS Section online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Fidelity Investments Instructions for Completing IRS Section to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out Fidelity Investments Instructions for Completing IRS Section on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Fidelity Investments Instructions for Completing IRS Section. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Fidelity Investments Instructions for Completing IRS Section 83(b)?

Fidelity Investments Instructions for Completing IRS Section 83(b) provides guidelines for employees and service providers who receive restricted stock or other forms of compensation that may be subject to vesting. It outlines the process of filing an 83(b) election with the IRS to potentially minimize tax liabilities.

Who is required to file Fidelity Investments Instructions for Completing IRS Section 83(b)?

Individuals who receive shares or stock options subject to vesting must file the IRS Section 83(b) election. This includes employees, contractors, and other service providers who receive stock as part of their compensation.

How to fill out Fidelity Investments Instructions for Completing IRS Section 83(b)?

To fill out the 83(b) election form, one must provide personal identification information, details of the property being transferred, the value of the property, and the date of transfer. After completing the form, it should be filed with the IRS and a copy should be sent to the employer.

What is the purpose of Fidelity Investments Instructions for Completing IRS Section 83(b)?

The purpose is to inform individuals about the benefits and requirements of making an 83(b) election, which allows them to include the fair market value of the shares at the time of grant as taxable income, thus potentially lowering their future tax burden.

What information must be reported on Fidelity Investments Instructions for Completing IRS Section 83(b)?

The reported information must include the taxpayer's name, address, and Social Security number, a description of the property, the date of the property transfer, the fair market value at the time of transfer, and any restrictions on the property.

Fill out your Fidelity Investments Instructions for Completing IRS Section online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Investments Instructions For Completing IRS Section is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.